Resilience Is The Mother Of All Virtues And The Key To Unlocking Successful Independent Power Projects In Nigeria

The successful completion of the Azura Edo 450 MW gas-fired power project in 2016 was hailed at the time as setting the blueprint for future independent power projects in Nigeria. The $900 million plant, which gathered 20 international banks and equity financing partners from more than nine countries, took over six years of project development and construction. It was intended to provide a pathway for others to enter into similar agreements and unlock financing for power sector investment. But five years on, no new independent power projects have come to fruition.

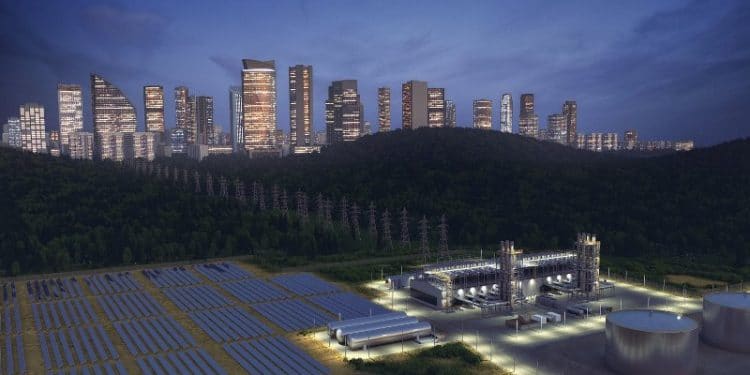

Today, grid generating potential is just over 12 GW in Nigeria. More than 40% of the population lack access to electricity, and those with access, suffer regular power cuts and outages. This is not due to a lack of projects or ambition. With its Vision 30:30:30 the government is committed to deliver 30GW of electricity with 30% renewable energy mix by 2030.

As the largest economy in Africa, with huge gas reserves and high solar energy potential, Nigeria has all the natural resources necessary to meet these targets. However, there are three major and interconnected challenges to overcome to complete successful IPP projects, namely the fragile energy transportation and distribution infrastructures, the ambitious yet incomplete energy reforms, and finally, securing access to long-term international project financing.

The fragility of the existing energy infrastructures, the relative immaturity of the power sector reforms, combined with security and currency risks, create enormous barriers to entry for IPP projects in Nigeria. While there is no simple answer to resolve this, our experience is that a holistic approach to cover all project parameters is crucial and that demonstrating flexibility and resilience over the long term is of paramount importance.

An improving, but still complex regulatory environment

Nigeria’s power sector reforms began around ten years ago when the government launched an ambitious privatization and unbundling of the vertically integrated historical utility. Power generation plants were transferred to privately held GENCOs, the distribution network went to partially privately owned DISCOs, while the transmission network was kept under government ownership, managed for some time by the private sector.

The resulting regulatory environment is complex and still evolving today, creating significant uncertainty for project developers. Despite a strong legal framework and the many government efforts to implement reforms, project developers and sponsors need to navigate multiple agencies and government organizations with sometimes conflicting or unaligned processes.

To cope with this uncertainty, information must be checked and rechecked at various levels to safeguard a project ecosystem that requires constant monitoring and validation. Keeping abreast of developments requires continuous contact and resilience, mobilizing full time resources to stay in the game.

Mitigating project development risk with a 360° approach

Major energy infrastructure projects are multi-million-dollar transactions that require long cycles to develop and even longer to payback. Having a reliable turnkey solution provider, with the experience of international project development, can make a significant difference for future IPP projects.

Independent Power Producers must also beyond the capability to mobilize technical resources, such as engineering, engine manufacturing, construction, and service teams, work with consultants and advisors to bring expertise on environmental and social topics, on connecting infrastructures, primary fuel supply legal matters and accordingly to contribute to internal and external project development costs.

From engineering, procurement and construction (EPC) through to operation and maintenance (O&M), successful project finance relies upon complex back-to-back contractual agreement structures to secure access to the gas, the grid, and the offtake of the generated power. Once a bankable model has been designed, only then can projects raise finance from international development finance institutions (DFIs), international and local commercial banks and other accessible funds.

In addition to coordinating project finance, and to mobilizing internal and external resources, the ability of the IPP to share the development risk by taking minority equity stakes in projects is also paramount.

Selecting the right technologies in a challenging environment

Gas fuels more than 80% of the nation’s power generation capacity in Nigeria. But in order to generate reliable power from gas in a challenging environment, not all technologies are equal.

For instance, the challenging conditions of gas transportation and distribution, combined with the fluctuating electricity loads, makes it difficult for traditional large gas-turbine based power plant projects to operate efficiently.

Gas turbines operate on a continuous combustion process, requiring a constant supply of gas and a stable dispatched load to generate consistent power output. Supply from the Escravos-Lagos Pipeline System (ELPS), which forms the backbone of Nigeria’s gas transportation system, is subject to disruptions due to a number of upstream constraints and its own operational challenges. This makes it challenging to respond to the daily variations in customer demand. The result is stranded generation assets and transmission bottlenecks causing shutdowns at some of the country’s largest power plants.

Power plants with reciprocating gas engines, however, can run with lower gas pressures and provide high efficiency at Nigerian site conditions with high temperatures and humidity. Medium-sized projects of 250 MW can make a significant contribution to meeting the country’s energy demand as they are able to operate with a large spectrum of gas qualities and other liquid fuels provided through other supply infrastructures. More importantly, they can provide the flexibility and resilience required to accommodate varying loads either due to consumption patterns or to challenged transmission and distribution infrastructures. As renewable projects are progressively integrated into the mix of Nigerian grid connected power plants, the need for flexibility and agility to adapt to intermittent sources of electricity such as solar and wind will increase.

Enabling the “Decade of Gas” vision

Whilst there is no single solution or quick fix to solve the challenges of Nigeria’s power sector, the ability to deploy the appropriate power production technologies combined with proven project management know-how will go a long way to overcome these barriers and take advantage of the government’s “Decade of Gas” vision. High-quality IPP projects based on gas engine technology will contribute to meeting the country’s unserved energy demand, whilst reducing dependence on expensive diesel generators and drastically reducing CO2 emissions.

![[Kenya] Digital credit provider Tala disbursed Sh240 billion in loans in eight years 19 [Kenya] Digital credit provider Tala disbursed Sh240 billion in loans in eight years](https://theafricanbusiness.com/wp-content/uploads/2023/02/TALA-APP-360x180.jpg)